Capital Markets Are Down but Not Quite Dead

NEW YORK – A potent concoction of slowing capital markets and inactivity in Washington D.C. bears the majority of blame for the industry’s lackluster fundraising performance in 2023, but poor growth and contracting margins are what’s really been keeping investors away.

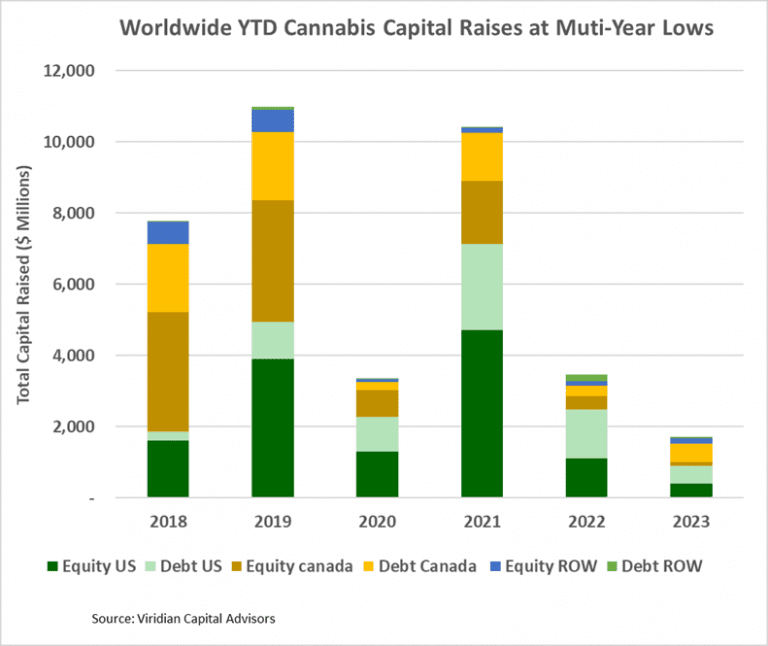

According to the cannabis deal tracker provided by Viridian Capital Advisors, worldwide cannabis capital raises are expected to hit a multi-year low by the end of December. The $1.72 billion closed through the first 41 weeks of the year is 50 percent short of last year’s figures. Public companies account for 73 percent of the total capital raised in 2023, down slightly from the volume raised in 2022 and lower than any other period since 2019. Making matters more difficult in the months to come, debt represents 61 percent of the total capital raised, significantly higher than any comparable period since 2018.

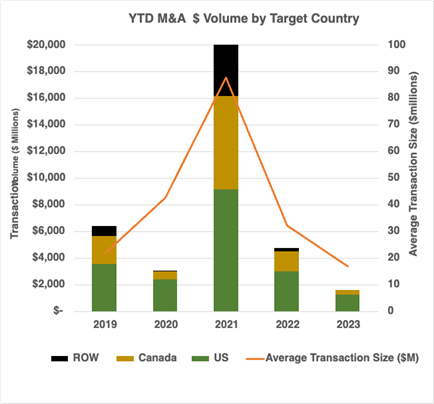

“The low activity level in both capital raises and [mergers and acquisitions] activity owes a lot to the inactivity in Washington D.C. with regard to any sort of meaningful cannabis legislative reform and certainly movements in those areas such as the SAFER Banking Act,” said Frank Colombo, a chartered financial analyst and the director of data analytics at Viridian Capital Advisors. “The potential rescheduling to [Schedule III] will have strong positive impacts on capital raising and [mergers and acquisitions].

“However, the capital markets slowdown and lack of legislative reform are only the obvious points that are easy to point to,” he continued. “Less discussed but equally important is the downturn in the industry’s economics. Cannabis is always mentioned as a growth industry, but consensus estimates of the 2023 revenues for the ten largest [multistate operators] show a growth of only about 1 percent from 2022.”

According to Colombo, disappointing rollouts in markets like New York, the pernicious impact of wholesale price contraction across the country, and inflationary cost increases created a perfect storm to hinder the industry’s profitability and attractiveness to growth-seeking investors.

“The same ten [largest] MSOs are projected to have aggregate EBITDA margins of only 24 percent in 2023, down from 25 percent in 2022,” said Colombo. “And mind you, this is for the crème de la crème of the industry. Many smaller players with less access to capital have been facing greater downturns, especially in markets like California that have suffered greater price contractions.”

But much like carefully stressing cannabis plants encourages them to focus their limited resources on producing better buds, schwazzing could have its place in forcing companies to strengthen the weakest parts of their operations and focus on what matters most.

To survive in 2023, many companies have been forced to lay off workers, exit difficult markets, contract working capital, eliminate poorly performing SKUs, and apply far greater scrutiny when exploring mergers and acquisitions. While none of these steps are attractive when things are going well, no industry of significance can skip its painful transformation into a lean, mean, publicly-traded revenue stream worthy of fresh investment dollars.

“The good news is that the industry is likely to be stronger coming out of this period,” said Colombo. “We have at least three major population states which are potential new adult recreational states: Pennsylvania, Ohio, and Florida. The opening of rec markets in these states will demand capital, which will need to be raised. Alternatively, companies may choose to expand through acquisition. Either way, new states equals upticks in capital markets activities.”

Comments

Post a Comment